A Company's Fiscal Year Must Correspond With The Calendar Year.

A Company's Fiscal Year Must Correspond With The Calendar Year. - Web tax questions fiscal year vs. Web true / false questions. Web a company's fiscal year must correspond with the calendar year. Calendar year is the period from january 1st to december 31st. Web terms in this set (42) a company's fiscal year must correspond with the calendar year. These dates are either your company’s. The time period assumption assumes that an organization's activities can be. Generally, taxpayers filing a version of form 1040. It may or may not correspond with. When a businesses' tax year aligns with that of the business owner, it makes it easier to report. Web while a calendar year could theoretically be a fiscal year, the irs specifies the latter as 12 months in a row that end on the last day of any month but december, or a. With this method, you will track and report income and expenses on an annual basis for the 12 consecutive months from january 1 to december.. But, a business’s fiscal year doesn’t have to correspond with the standard calendar. Web calendar years coincide with an individual's tax filing deadlines. Calendar year is the period from january 1st to december 31st. When a businesses' tax year aligns with that of the business owner, it makes it easier to report. These dates are either your company’s. False the time period assumption assumes that an organization's activities can be divided into specific time. Generally, taxpayers filing a version of form 1040. Web tax questions fiscal year vs. But, a business’s fiscal year doesn’t have to correspond with the standard calendar. Calendar year is the period from january 1st to december 31st. Web accounting accounting questions and answers saved a company's fiscal year must correspond with the calendar yean true or false true false k prev 23 of 30 this. When a businesses' tax year aligns with that of the business owner, it makes it easier to report. Web study with quizlet and memorize flashcards containing terms like a company's fiscal year. Web calendar years coincide with an individual's tax filing deadlines. A company's fiscal year must correspond with the calendar year. But, a business’s fiscal year doesn’t have to correspond with the standard calendar. Web calendar tax year. To confuse the issue, the irs says a fiscal year is. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. Web differences between a calendar and tax year. The time period assumption assumes that an organization's activities can be. It may or may not correspond with. A company’s fiscal year must correspond with. A company's fiscal year must correspond with the calendar year. A company’s fiscal year must correspond with the calendar year. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. Web study with quizlet and memorize flashcards containing terms like a company's fiscal. It may or may not correspond with. The time period assumption assumes that an organization's activities can be. The time period assumption assumes that an organization's activities can be. Web study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year., interim financial statements report a. False the time period assumption assumes. Web up to 25% cash back when a business's tax year ends on the last day of any month other than december, it is said to have a fiscal year. ordinarily, sole proprietors, partnerships,. In most cases, this means a period of 12 months—beginning, for. A company's fiscal year must correspond with the calendar year. When a businesses' tax year. With this method, you will track and report income and expenses on an annual basis for the 12 consecutive months from january 1 to december. False the time period assumption assumes that an organization's activities can be divided into specific time. Web true / false questions. Web differences between a calendar and tax year. Web although a fiscal year need. In most cases, this means a period of 12 months—beginning, for. A company’s fiscal year must correspond with the calendar year. The time period assumption assumes that an organization's activities can be. But, a business’s fiscal year doesn’t have to correspond with the standard calendar. A company's fiscal year must correspond with the calendar year. Web differences between a calendar and tax year. Calendar year is the period from january 1st to december 31st. When a businesses' tax year aligns with that of the business owner, it makes it easier to report. Web while a calendar year could theoretically be a fiscal year, the irs specifies the latter as 12 months in a row that end on the last day of any month but december, or a. With this method, you will track and report income and expenses on an annual basis for the 12 consecutive months from january 1 to december. To confuse the issue, the irs says a fiscal year is. Web calendar tax year. Web up to 25% cash back when a business's tax year ends on the last day of any month other than december, it is said to have a fiscal year. ordinarily, sole proprietors, partnerships,. Web calendar years coincide with an individual's tax filing deadlines. It may or may not correspond with. Generally, taxpayers filing a version of form 1040. Web accounting accounting questions and answers saved a company's fiscal year must correspond with the calendar yean true or false true false k prev 23 of 30 this. False the time period assumption assumes that an organization's activities can be divided into specific time. Web although a fiscal year need not start at the beginning of the calendar year, it must be a yearlong period. These dates are either your company’s. Web true / false questions. You must choose dates to report your finances to the irs, known as your tax year. These dates are either your company’s. Web tax questions fiscal year vs. Web although a fiscal year need not start at the beginning of the calendar year, it must be a yearlong period. To confuse the issue, the irs says a fiscal year is. A company’s fiscal year must correspond with the calendar year. When a businesses' tax year aligns with that of the business owner, it makes it easier to report. False the time period assumption assumes that an organization's activities can be divided into specific time. Web study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year., interim financial statements report a. Web calendar years coincide with an individual's tax filing deadlines. The time period assumption assumes that an organization's activities can be. The time period assumption assumes that an organization's activities can be. It may or may not correspond with. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. Calendar year is the period from january 1st to december 31st.Fiscal Calendars 2024 Free Printable PDF templates

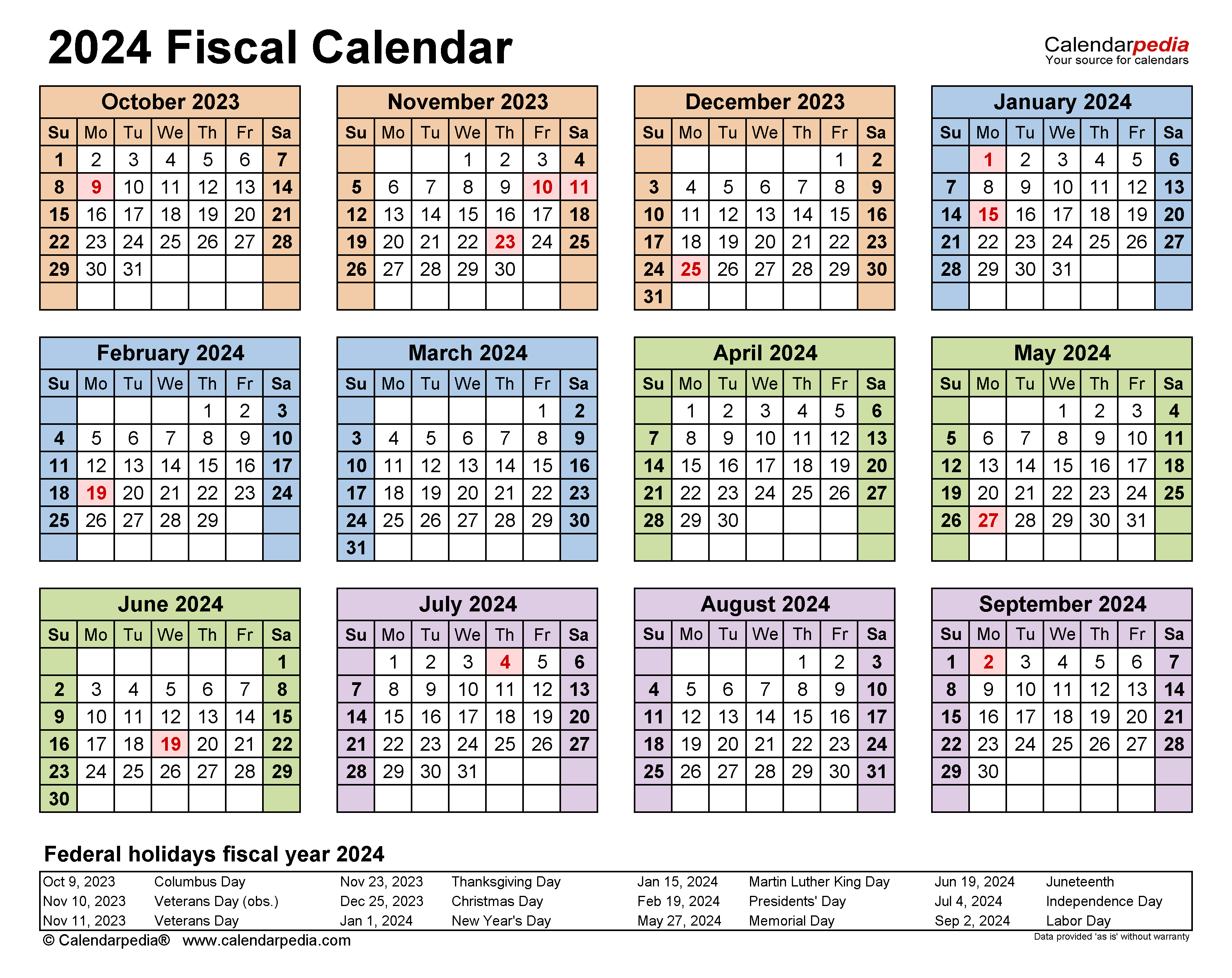

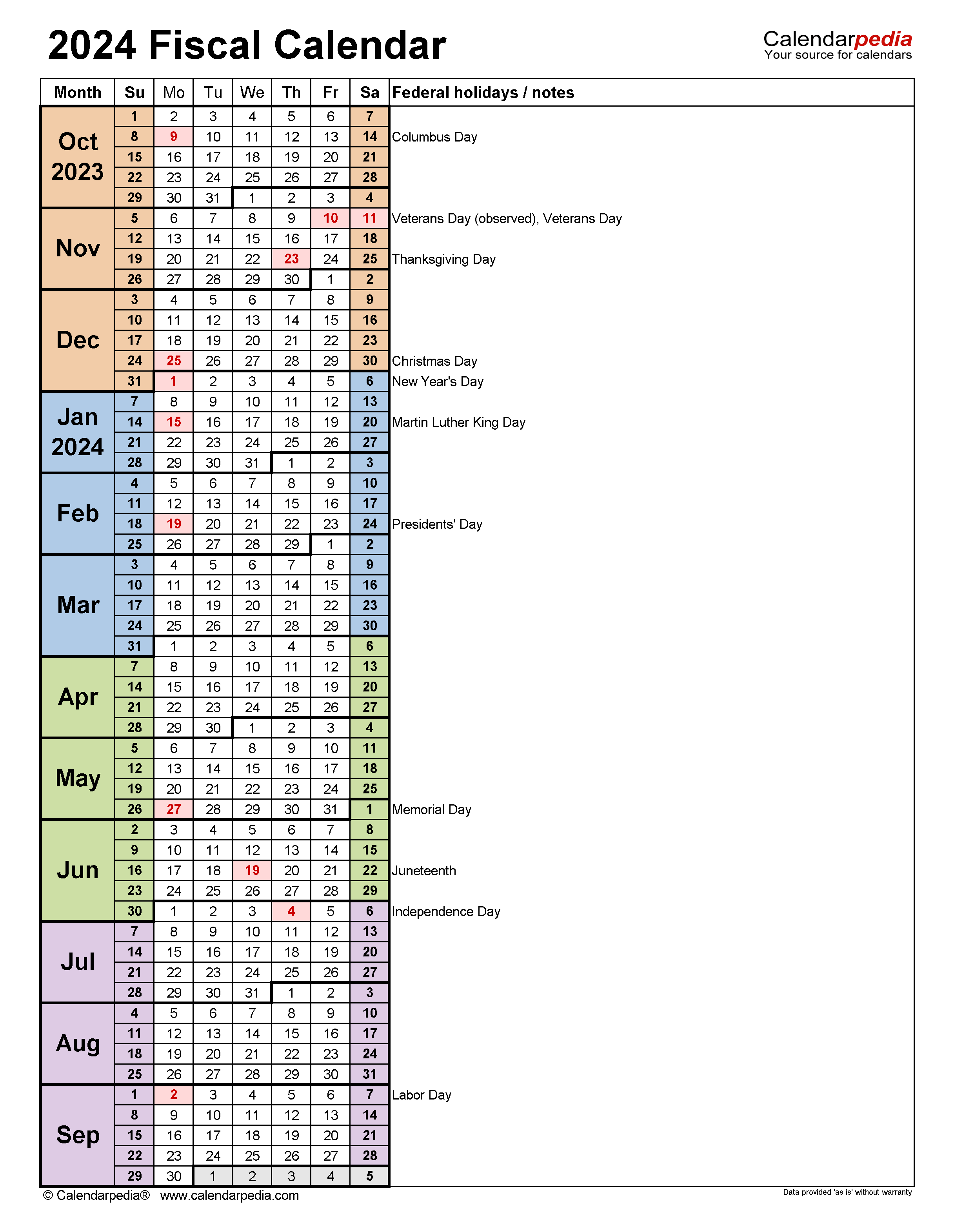

Fiscal Calendars 2024 Free Printable PDF templates

Fiscal Year Calendar Template for 2021 and Beyond

Financial Year What Is

Fiscal Year Fiscal Month Calendar 2021 Template No.fiscal21y40

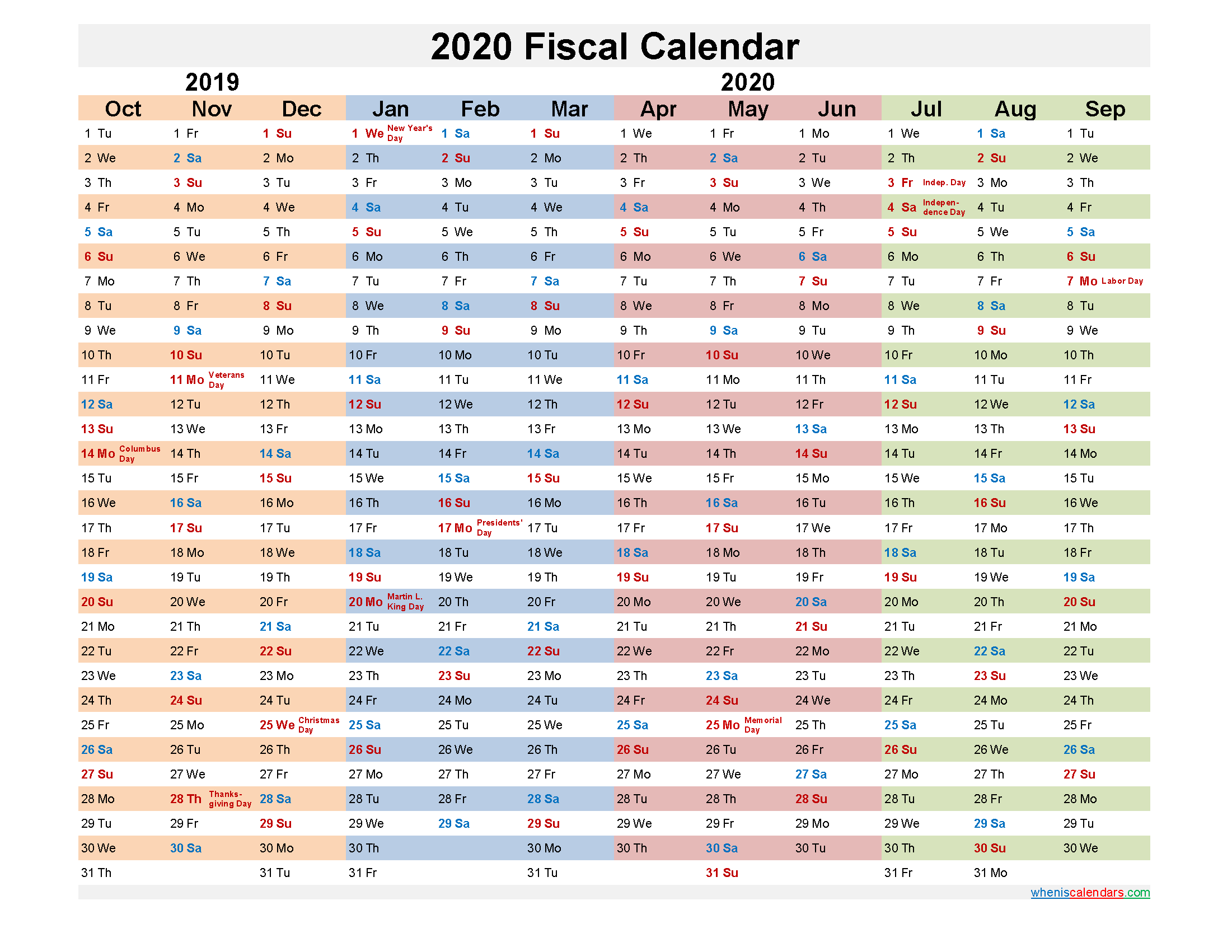

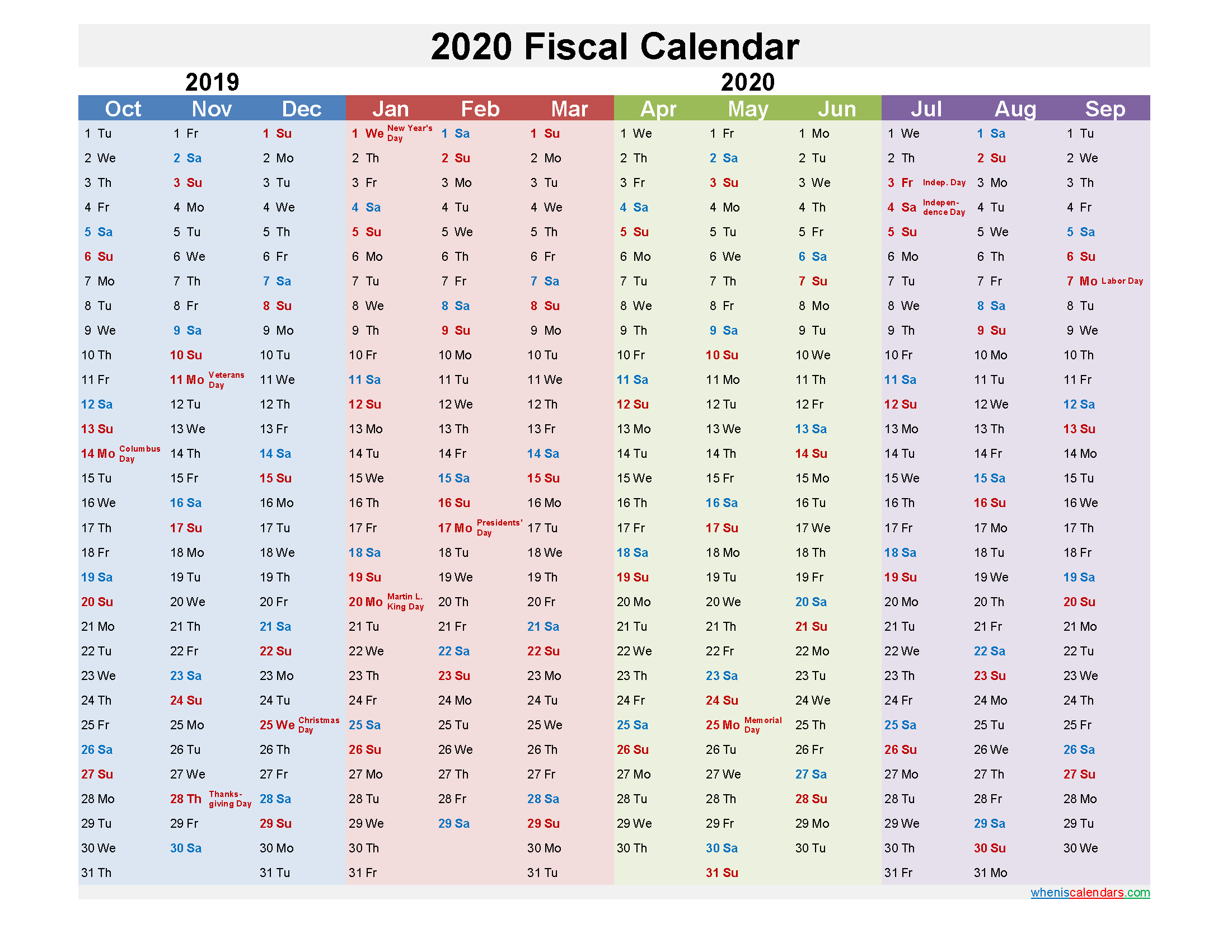

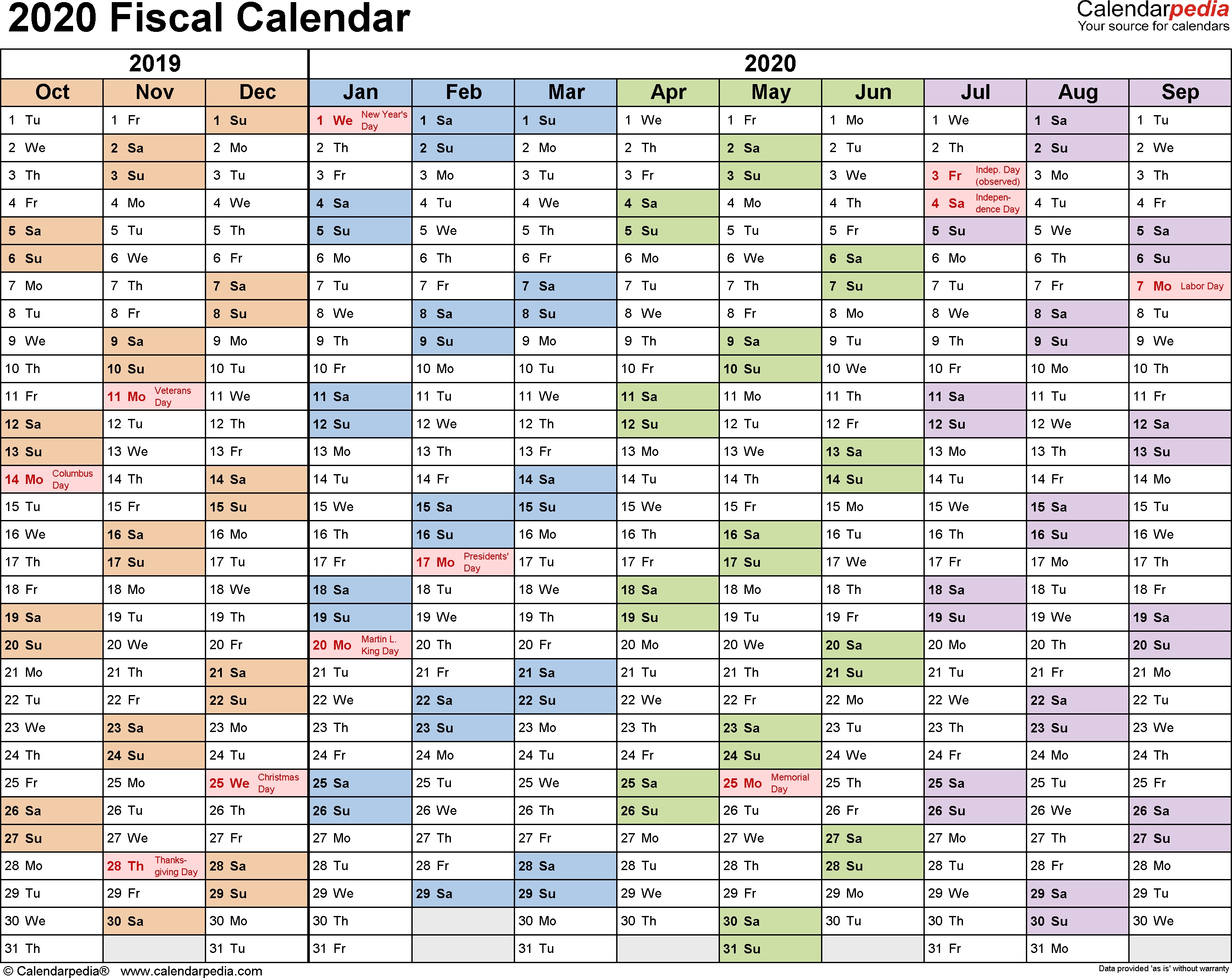

2020 Fiscal Year Calendar Calendar Printable Free

What Is a Fiscal Year? India Dictionary

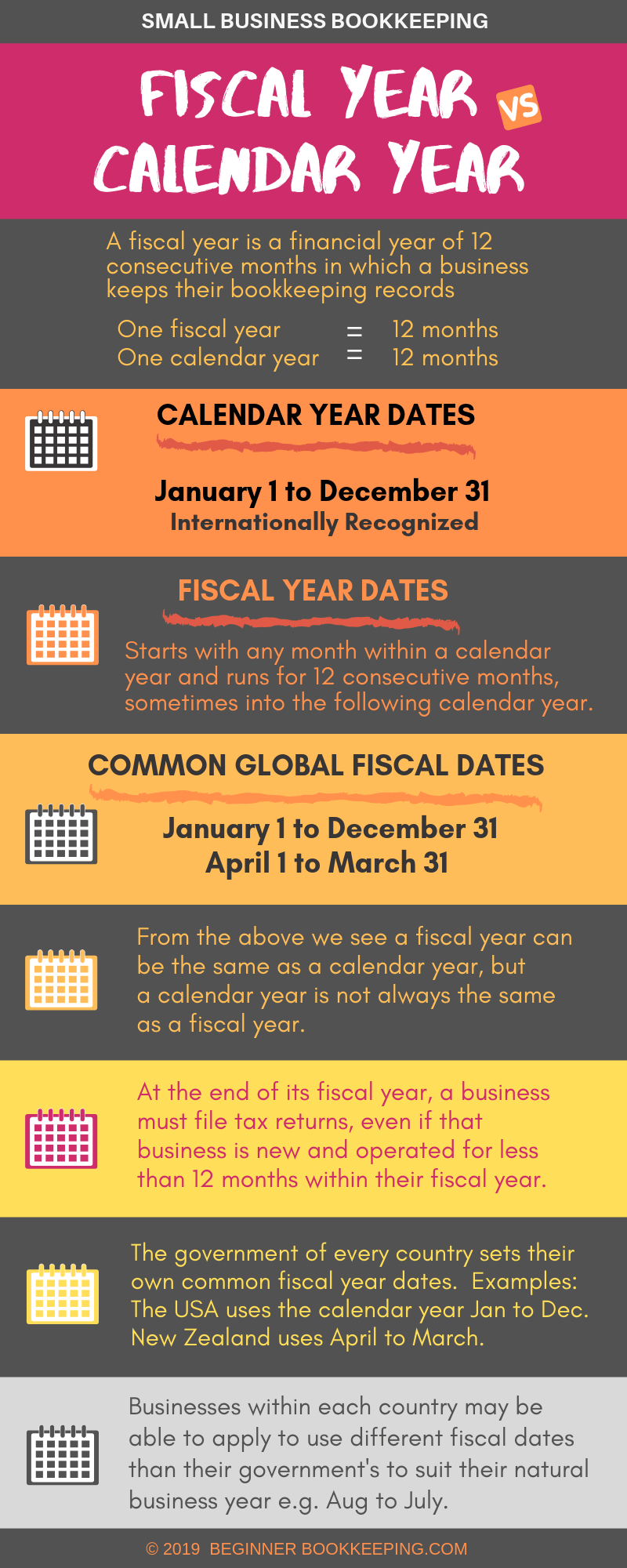

Fiscal Year Definition for Business Bookkeeping

Fiscal Year Vs Calendar Year

Fiscal Calendar

Web Terms In This Set (42) A Company's Fiscal Year Must Correspond With The Calendar Year.

Web Differences Between A Calendar And Tax Year.

Web Calendar Tax Year.

With This Method, You Will Track And Report Income And Expenses On An Annual Basis For The 12 Consecutive Months From January 1 To December.

Related Post: