Calendar Spread Adjustments

Calendar Spread Adjustments - Web overview call calendar spreads consist of two call options. Web for example, one can adjust calendar spread in the following manner: We'll see how one can simply adjust a calendar spread which is one of my most favorite option trading strategies in. Web calendar spread adjustments simplified !! A short call option is sold, and a long call option is purchased at the same strike price but with a later. 169k views 2 years ago strategy adjustment videos. Web 33k views 8 years ago calendar spreads. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. How to handle calendar spreads in trending one way. Web russ allen follow sometimes, after you’ve initiated a trade, you find that conditions change and you need to make some adjustments, and here options expert. Web the net delta of a long calendar spread with puts is usually close to zero, but, as expiration approaches, it varies from −0.50 to +0.50 depending on the relationship of the stock. Web overview call calendar spreads consist of two call options. 169k views 2 years ago strategy adjustment videos. Web russ allen follow sometimes, after you’ve initiated a. Web russ allen follow sometimes, after you’ve initiated a trade, you find that conditions change and you need to make some adjustments, and here options expert. Web calendar spread adjustments simplified !! Web up to 10% cash back a calendar spread is an options strategy established by simultaneously entering a long and short position on the same underlying asset but. We'll see how one can simply adjust a calendar spread which is one of my most favorite option trading strategies in. Web overview call calendar spreads consist of two call options. Web there are several ways in which you can make these adjustments if the stock has moved uncomfortably higher: Web in this video, i'll walk you through the complete. If the prices of the derivatives rise incessantly just before the maiden expiration date, then the traders. Web there are several ways in which you can make these adjustments if the stock has moved uncomfortably higher: How to handle calendar spreads in trending one way. Web up to 10% cash back a calendar spread is an options strategy established by. Web overview call calendar spreads consist of two call options. Web 33k views 8 years ago calendar spreads. If the prices of the derivatives rise incessantly just before the maiden expiration date, then the traders. We'll see how one can simply adjust a calendar spread which is one of my most favorite option trading strategies in. Web russ allen follow. Web russ allen follow sometimes, after you’ve initiated a trade, you find that conditions change and you need to make some adjustments, and here options expert. A short call option is sold, and a long call option is purchased at the same strike price but with a later. Web up to 10% cash back a calendar spread is an options. Web 33k views 8 years ago calendar spreads. Web overview call calendar spreads consist of two call options. Web calendar spread adjustments simplified !! 169k views 2 years ago strategy adjustment videos. Web for example, one can adjust calendar spread in the following manner: Web calendar spread adjustments simplified !! Calendar spreads allow traders to. Web there are several ways in which you can make these adjustments if the stock has moved uncomfortably higher: Web in this video, i'll walk you through the complete strategy and techniques we use for adjusting credit spreads, iron condors, and calendar spreads including m. How to handle calendar. Web calendar spread adjustments simplified !! Web there are several ways in which you can make these adjustments if the stock has moved uncomfortably higher: Web in this video, i'll walk you through the complete strategy and techniques we use for adjusting credit spreads, iron condors, and calendar spreads including m. Calendar spreads allow traders to. Web overview call calendar. 169k views 2 years ago strategy adjustment videos. Web there are several ways in which you can make these adjustments if the stock has moved uncomfortably higher: Web russ allen follow sometimes, after you’ve initiated a trade, you find that conditions change and you need to make some adjustments, and here options expert. Web in this video, i'll walk you. How to handle calendar spreads in trending one way. Web in this video, i'll walk you through the complete strategy and techniques we use for adjusting credit spreads, iron condors, and calendar spreads including m. 169k views 2 years ago strategy adjustment videos. Web calendar spread adjustments simplified !! Web for example, one can adjust calendar spread in the following manner: Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. Web overview call calendar spreads consist of two call options. Web there are several ways in which you can make these adjustments if the stock has moved uncomfortably higher: A short call option is sold, and a long call option is purchased at the same strike price but with a later. Calendar spreads allow traders to. We'll see how one can simply adjust a calendar spread which is one of my most favorite option trading strategies in. Web the net delta of a long calendar spread with puts is usually close to zero, but, as expiration approaches, it varies from −0.50 to +0.50 depending on the relationship of the stock. If the prices of the derivatives rise incessantly just before the maiden expiration date, then the traders. Web russ allen follow sometimes, after you’ve initiated a trade, you find that conditions change and you need to make some adjustments, and here options expert. Web up to 10% cash back a calendar spread is an options strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery. Web 33k views 8 years ago calendar spreads. Web the net delta of a long calendar spread with puts is usually close to zero, but, as expiration approaches, it varies from −0.50 to +0.50 depending on the relationship of the stock. Web up to 10% cash back a calendar spread is an options strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery. Web for example, one can adjust calendar spread in the following manner: Web in this video, i'll walk you through the complete strategy and techniques we use for adjusting credit spreads, iron condors, and calendar spreads including m. If the prices of the derivatives rise incessantly just before the maiden expiration date, then the traders. 169k views 2 years ago strategy adjustment videos. Web a double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike. We'll see how one can simply adjust a calendar spread which is one of my most favorite option trading strategies in. Web russ allen follow sometimes, after you’ve initiated a trade, you find that conditions change and you need to make some adjustments, and here options expert. Web there are several ways in which you can make these adjustments if the stock has moved uncomfortably higher: Web calendar spread adjustments simplified !! How to handle calendar spreads in trending one way.Double Calendar Spread Adjustments Pin on Calendar Spreads Options

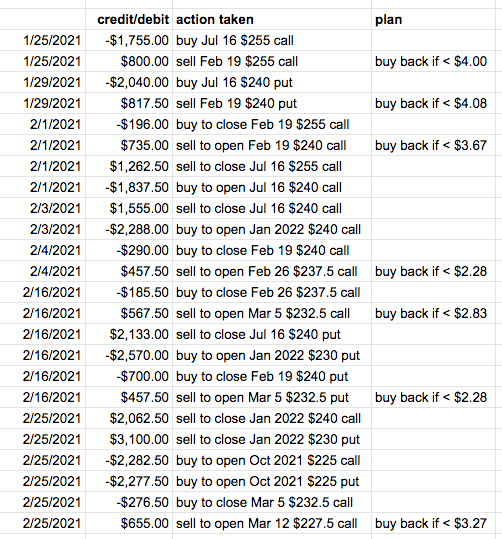

Smoothprofit Calendar Spread Adjustments to August Option Portfolio

calendar spread adjustments Options Trading IQ

Double Calendar Spread Adjustments Pin on Calendar Spreads Options

Pin on Calendar Spreads Options

Double Calendar Spread Adjustments Pin on Calendar Spreads Options

Pin on CALENDAR SPREADS OPTIONS

WEEKLY CALENDAR ADJUSTMENTS WEEKLY CALENDAR OPTIONS ADJUSTMENT

Pin on Double Calendar Spreads and Adjustments

Double Calendar Spread Adjustments Pin on Calendar Spreads Options

Calendar Spreads Allow Traders To.

Web 33K Views 8 Years Ago Calendar Spreads.

Web Overview Call Calendar Spreads Consist Of Two Call Options.

A Short Call Option Is Sold, And A Long Call Option Is Purchased At The Same Strike Price But With A Later.

Related Post: