Calendar Spread Calculator

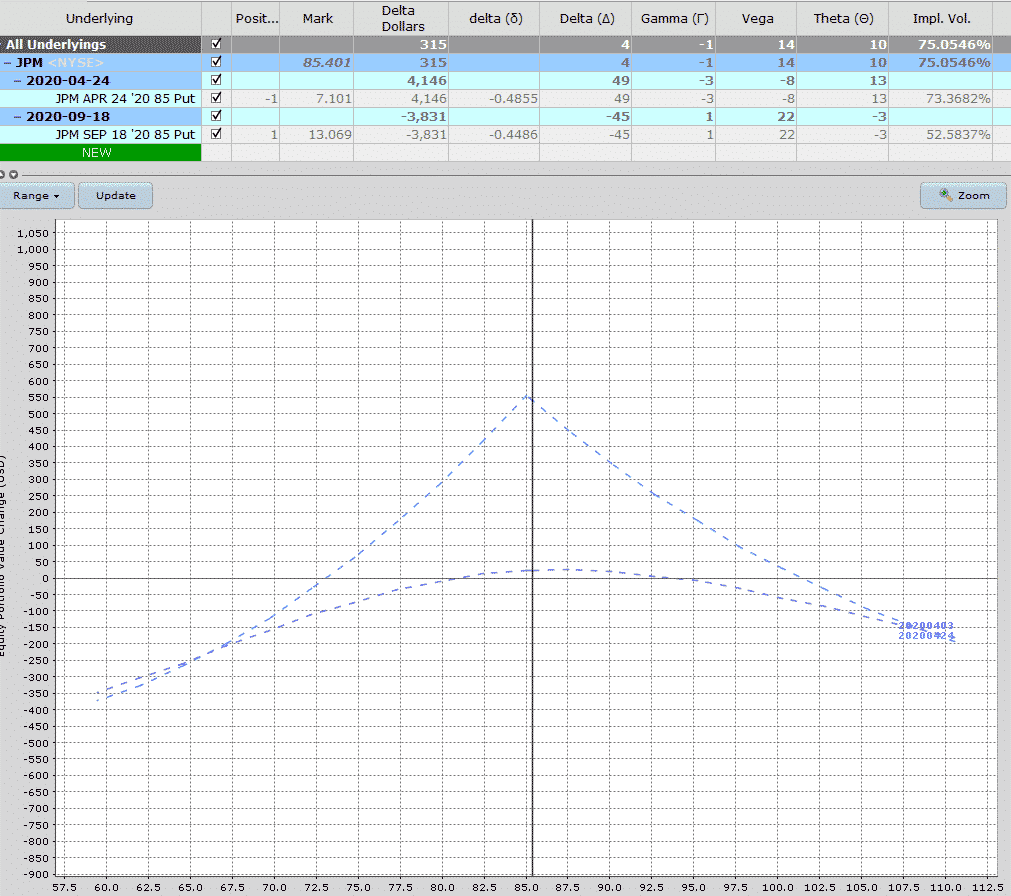

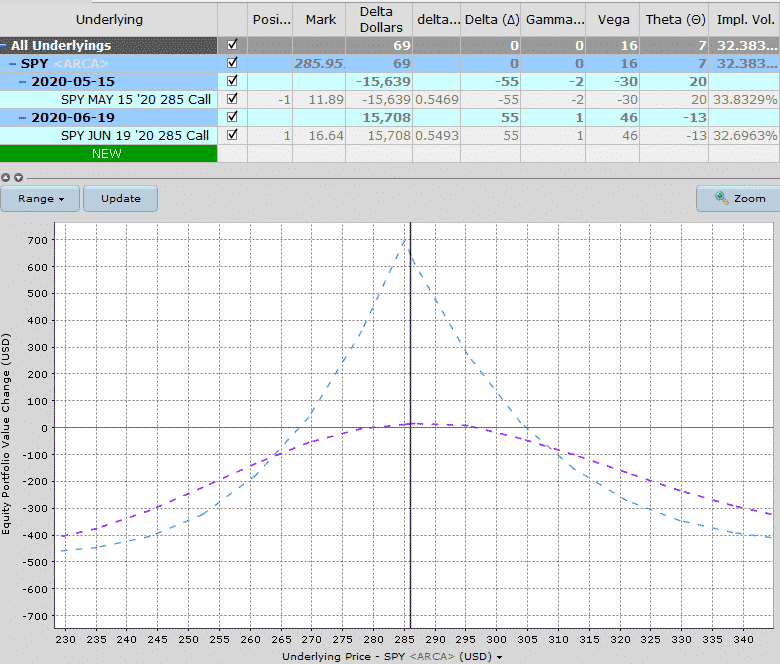

Calendar Spread Calculator - Web calendar spreads defined. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Clicking on the chart icon on the calendar put spread. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Duration between two times and dates. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on. Web enter a start date and add or subtract any number of days, months, or years. How many years, months, days, hours, minutes, and seconds are there between two moments in time? Duration between two times and dates. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another. Web the calendar put spread calculator can. Duration between two times and dates. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web anytime you adjust a position, or roll a. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web enter a start date and add or subtract any number of days, months, or years. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web gordon scott what is. Duration between two times and dates. How many years, months, days, hours, minutes, and seconds are there between two moments in time? Clicking on the chart icon on the calendar put spread. Count days add days workdays add workdays weekday week № start date month: Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web (april 2020) in finance, a calendar spread (also called a time spread or. Count days add days workdays add workdays weekday week № start date month: Clicking on the chart icon on the calendar put spread. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. Web a calendar spread is an investment strategy. Clicking on the chart icon on the calendar put spread. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. Web gordon scott what is a calendar spread? Web updated october 31, 2021 reviewed by charles potters fact checked by pete. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Clicking on the chart icon on. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. How many years, months, days, hours, minutes, and seconds are there between two. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Count days add days workdays add workdays weekday week № start date month: Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. Web calendar spreads defined. Web gordon scott what is a calendar spread? Duration between two times and dates. Clicking on the chart icon on the calendar put spread. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. How many years, months, days, hours, minutes, and seconds are there between two moments in time? Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another. Web enter a start date and add or subtract any number of days, months, or years. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web calendar spreads defined. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. How many years, months, days, hours, minutes, and seconds are there between two moments in time? Web gordon scott what is a calendar spread? Duration between two times and dates. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on. Clicking on the chart icon on the calendar put spread. Web enter a start date and add or subtract any number of days, months, or years. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another.27+ calendar spread calculator AlveyAlfaigh

Pin on Calendar Spreads Options

27+ calendar spread calculator AlveyAlfaigh

Calendar Call Spread Calculator

Pin on Option Trading Strategies

Pin on CALENDAR SPREADS OPTIONS

How To Trade Calendar Spreads The Complete Guide

Calendar Spreads 101 Everything You Need To Know

Calendar Spread Option Calculator CALNDA

Pin on CALENDAR SPREADS OPTIONS

Web Updated October 31, 2021 Reviewed By Charles Potters Fact Checked By Pete Rathburn Option Trading Strategies Offer Traders And Investors The Opportunity To.

Web Anytime You Adjust A Position, Or Roll A Position To A New Expiration Cycle, It Can Be Extremely Confusing On How To Figure Out Your Profit Or Loss.

Count Days Add Days Workdays Add Workdays Weekday Week № Start Date Month:

Web Learn How To Options On Futures Calendar Spreads To Design A Position That Minimizes Loss Potential While Offering Possibility Of Tremendous Profit.

Related Post: