Diagonal Calendar Spread

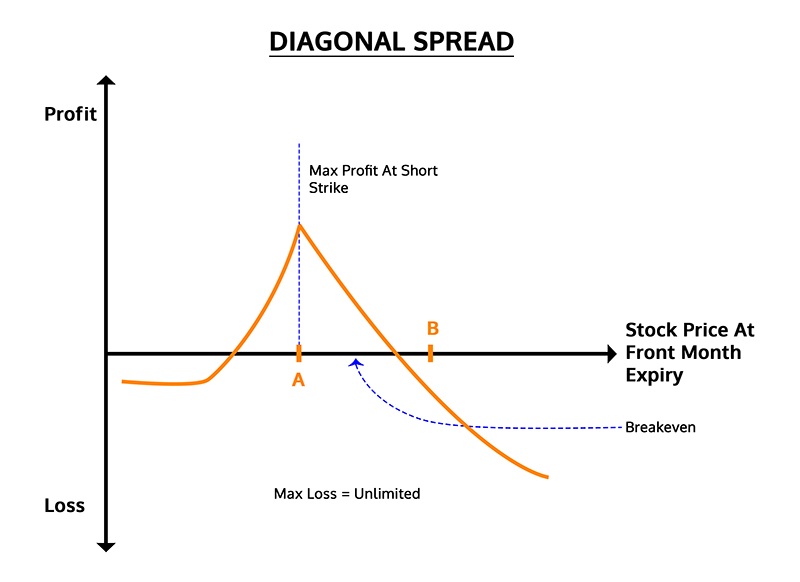

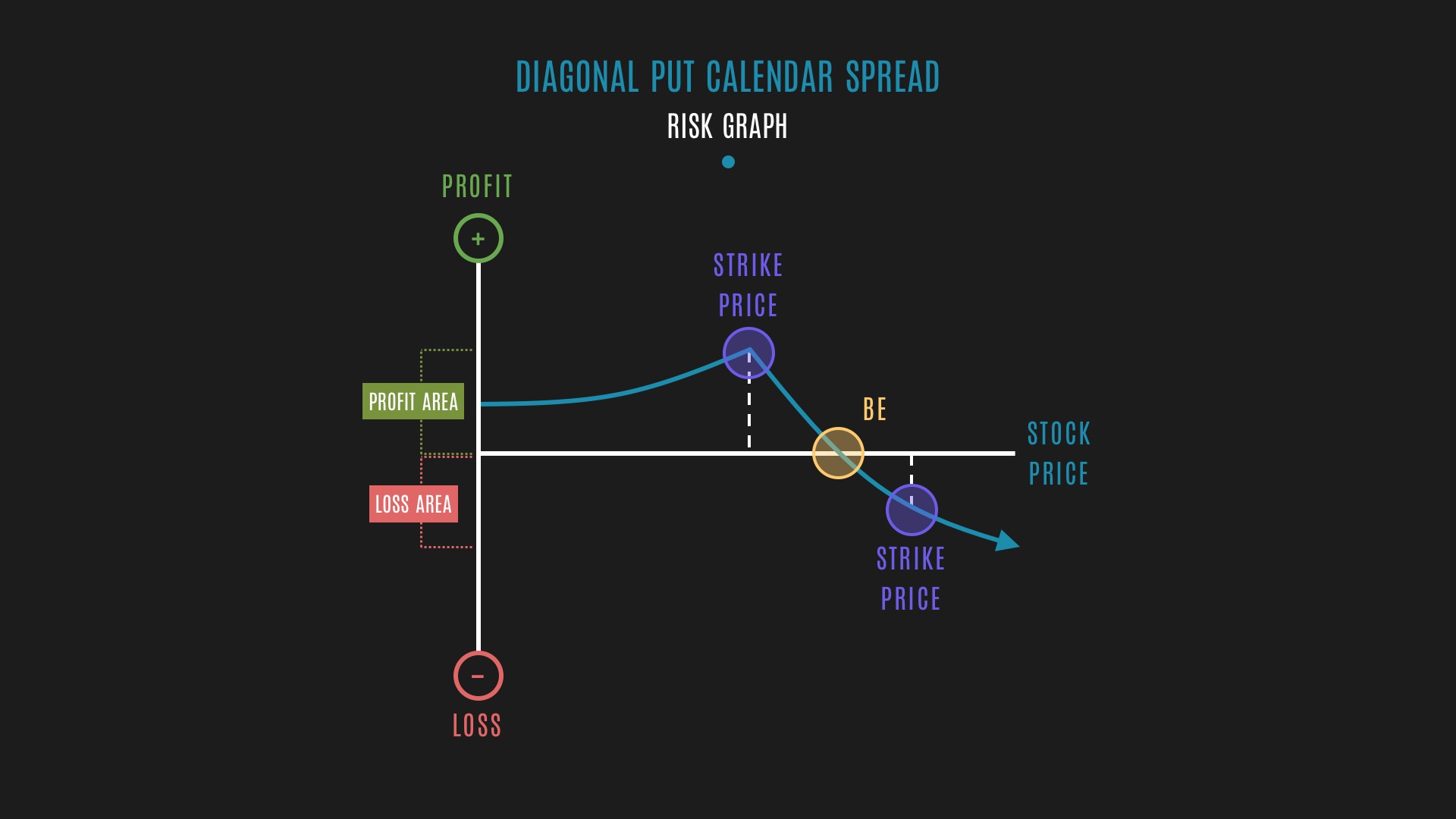

Diagonal Calendar Spread - A diagonal calendar spread uses different strike prices for the two options positions. Web if two different strike prices are used for each month, it is known as a diagonal spread. For example, say we initiate. The spread is known as diagonal spread as it. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with. Web one reason to like trading diagonal spreads is that they lend themselves to numerous position adjustments during the trading process. Web diagonal calendar spread. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. Web how does diagonal calendar put spread work in options trading? For example, say we initiate. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web how does diagonal calendar put spread work in options trading? Web a diagonal spread is. The other one is the short horizontal calendar put spread. Web diagonal calendar spread. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web a diagonal spread is similar. Web how does diagonal calendar put spread work in options trading? Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with.. Web diagonal calendar spread. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with. The spread is known as diagonal spread as it. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined. Web diagonal calendar spread. A diagonal spread is a modified calendar spread involving different strike prices. Here's a screenshot of what would officially be called a calendar. It is an options strategy established by simultaneously entering into a long and short position in two options of the same type—two call options or two put options—but with different strike prices and. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. It is an options strategy established by simultaneously entering into a long and short position in two options of the same type—two call options or two put options—but with different strike prices and different expiration dates. Web the diagonal spread is. The diagonal calendar put spread, also known as the put. Web diagonal calendar spread. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. For example, say we. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. The diagonal calendar put spread, also known as the. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. The diagonal calendar put spread, also known as the put. It is an options strategy established by simultaneously entering into a long and short position in two options of the same. A diagonal spread is a modified calendar spread involving different strike prices. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. The diagonal calendar put spread, also known as the put. The spread is known as diagonal spread. Web diagonal calendar spread. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. Here's a screenshot of what would officially be called a calendar. The diagonal calendar put spread, also known as the put. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. It is an options strategy established by simultaneously entering into a long and short position in two options of the same type—two call options or two put options—but with different strike prices and different expiration dates. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. The other one is the short horizontal calendar put spread. A diagonal spread is a modified calendar spread involving different strike prices. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock remains within a. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. The spread is known as diagonal spread as it. Web how does diagonal calendar put spread work in options trading? A diagonal calendar spread uses different strike prices for the two options positions. For example, say we initiate. Web one reason to like trading diagonal spreads is that they lend themselves to numerous position adjustments during the trading process. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock remains within a. Here's a screenshot of what would officially be called a calendar. For example, say we initiate. The other one is the short horizontal calendar put spread. It is an options strategy established by simultaneously entering into a long and short position in two options of the same type—two call options or two put options—but with different strike prices and different expiration dates. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. A diagonal spread is a modified calendar spread involving different strike prices. A diagonal calendar spread uses different strike prices for the two options positions. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. The spread is known as diagonal spread as it. Web how does diagonal calendar put spread work in options trading? Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web one reason to like trading diagonal spreads is that they lend themselves to numerous position adjustments during the trading process. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread.Case Study Goldman Sachs Double Calendar and Double Diagonal

Glossary Archive Tackle Trading

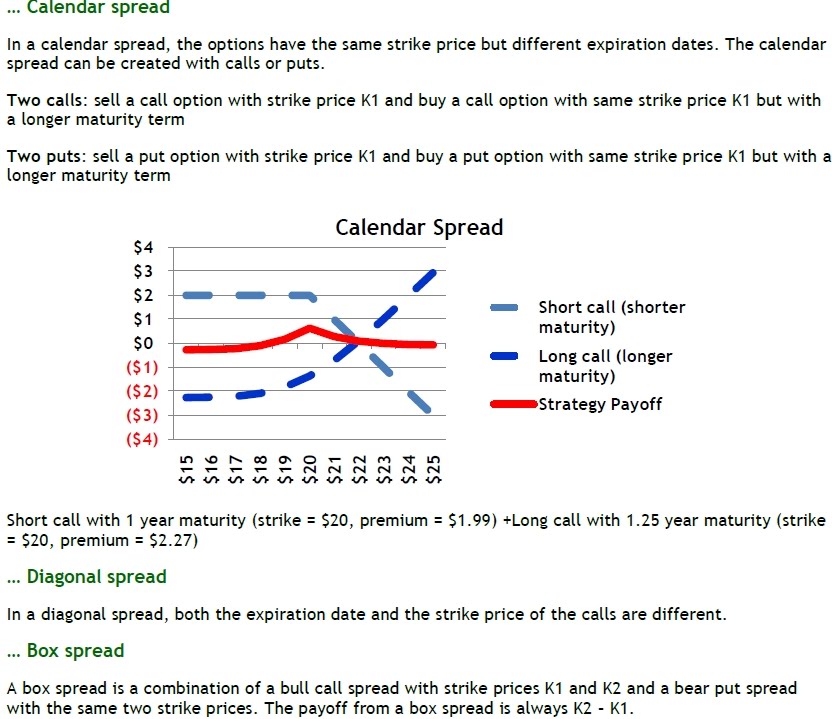

kthwow calendar spread, diagonal spread, box spread

Pin on CALENDAR SPREADS OPTIONS

DIAGONAL WEEKLY CALENDAR WITH ADJUSTMENTS WEEKLY CALENDAR SPREAD

Calendar Diagonal Option Spread [Why FB]? YouTube

Diagonal Spread Options Trading Strategy In Python

Diagonal Call Calendar Spread Smart Trading

Glossary Diagonal Put Calendar Spread example Tackle Trading

Pin on Double Calendar Spreads and Adjustments

Web Diagonal Calendar Spread.

Web If Two Different Strike Prices Are Used For Each Month, It Is Known As A Diagonal Spread.

The Diagonal Calendar Put Spread, Also Known As The Put.

Web The Diagonal Spread Is A Popular Options Trading Strategy That Involves The Simultaneous Purchase And Sale Of Options Of The Same Type But With Different Strike Prices And.

Related Post:

![Calendar Diagonal Option Spread [Why FB]? YouTube](https://i.ytimg.com/vi/qjfTMDLcmew/maxresdefault.jpg)