Double Calendar Spread

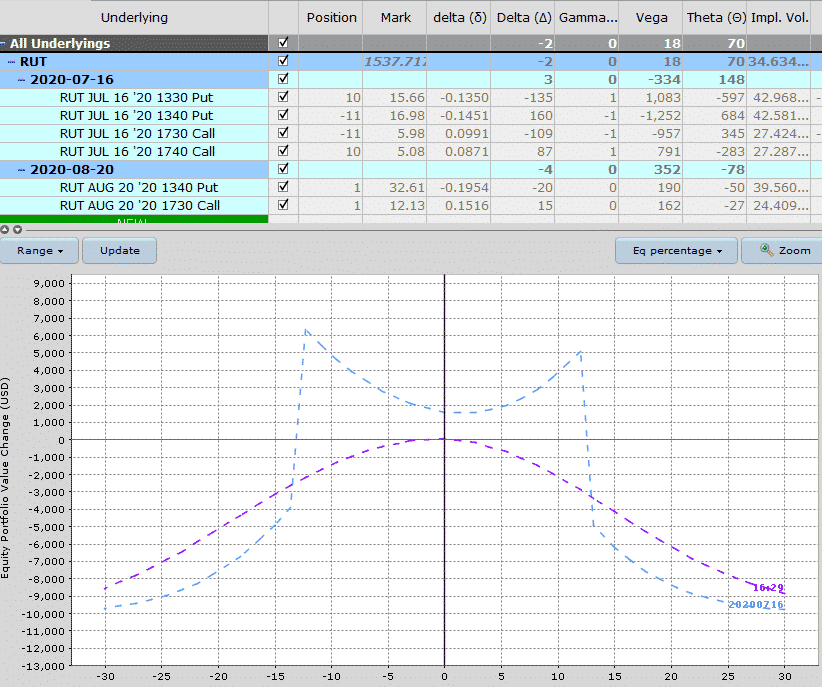

Double Calendar Spread - Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web 48k views 6 years ago. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Examples below of how to trade dcs in practice double calendar spreads are a short vol play and are typically used around earnings to take. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long side (which should be more than 90 days out). Web open an account stocks / options / futures / you deserve a better broker. These trades are a lot more systematic and require a lot less discretion. Web now there are a lot of advantages with the double calendar because it gives you a lot of spread range for the trade. It allows your options to deteriorate a lot quicker. Pricing our revolutionary low rates make for easier trading decisions.* These trades are a lot more systematic and require a lot less discretion. Web the double calendar spread! Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long side (which should be more than 90 days out). Examples below of how to trade dcs in practice double calendar. Web open an account stocks / options / futures / you deserve a better broker. Pricing our revolutionary low rates make for easier trading decisions.* Web 48k views 6 years ago. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Web the double. Pricing our revolutionary low rates make for easier trading decisions.* Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. It allows your options to deteriorate a lot quicker. Web this article discusses the double calendar spread strategy and how it increases the. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long side (which should be more than 90 days out). Web 48k. Web now there are a lot of advantages with the double calendar because it gives you a lot of spread range for the trade. Web this article discusses the double calendar spread strategy and how it increases the probability of profit over regular calendar spreads. Web a calendar spread is an option trade that involves buying and selling an option. Web 48k views 6 years ago. Web now there are a lot of advantages with the double calendar because it gives you a lot of spread range for the trade. It allows your options to deteriorate a lot quicker. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the. Examples below of how to trade dcs in practice double calendar spreads are a short vol play and are typically used around earnings to take. Web the double calendar spread! These trades are a lot more systematic and require a lot less discretion. Web since some more time has gone by, the current choice for the calendar spread would be. Web 48k views 6 years ago. Web now there are a lot of advantages with the double calendar because it gives you a lot of spread range for the trade. These trades are a lot more systematic and require a lot less discretion. Web the double calendar spread! Web a calendar spread is an option trade that involves buying and. These trades are a lot more systematic and require a lot less discretion. Pricing our revolutionary low rates make for easier trading decisions.* Web the double calendar spread! Web open an account stocks / options / futures / you deserve a better broker. Web since some more time has gone by, the current choice for the calendar spread would be. Web the double calendar spread! These trades are a lot more systematic and require a lot less discretion. It allows your options to deteriorate a lot quicker. Web open an account stocks / options / futures / you deserve a better broker. Web 48k views 6 years ago. Web the double calendar spread! Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long side (which should be more than 90 days out). Web this article discusses the double calendar spread strategy and how it increases the probability of profit over regular calendar spreads. Web open an account stocks / options / futures / you deserve a better broker. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. It allows your options to deteriorate a lot quicker. Web 48k views 6 years ago. Examples below of how to trade dcs in practice double calendar spreads are a short vol play and are typically used around earnings to take. Pricing our revolutionary low rates make for easier trading decisions.* These trades are a lot more systematic and require a lot less discretion. Web now there are a lot of advantages with the double calendar because it gives you a lot of spread range for the trade. These trades are a lot more systematic and require a lot less discretion. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. It allows your options to deteriorate a lot quicker. Web since some more time has gone by, the current choice for the calendar spread would be the octobers for the long side (which should be more than 90 days out). Pricing our revolutionary low rates make for easier trading decisions.* Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Web the double calendar spread! Web open an account stocks / options / futures / you deserve a better broker. Examples below of how to trade dcs in practice double calendar spreads are a short vol play and are typically used around earnings to take.Double Calendar Spreads Ultimate Guide With Examples

Pin on Double Calendar Spreads and Adjustments

Pin on CALENDAR SPREADS OPTIONS

Double Calendar Spreads Ultimate Guide With Examples

Pin on CALENDAR SPREADS OPTIONS

Pin on Double Calendar Spreads and Adjustments

Double Calendar Spreads Ultimate Guide With Examples

Pin on CALENDAR SPREADS OPTIONS

Pin on Calendar Spreads Options

Pin on CALENDAR SPREADS OPTIONS

Web This Article Discusses The Double Calendar Spread Strategy And How It Increases The Probability Of Profit Over Regular Calendar Spreads.

Web 48K Views 6 Years Ago.

Web Now There Are A Lot Of Advantages With The Double Calendar Because It Gives You A Lot Of Spread Range For The Trade.

Related Post: