Long Call Calendar Spread

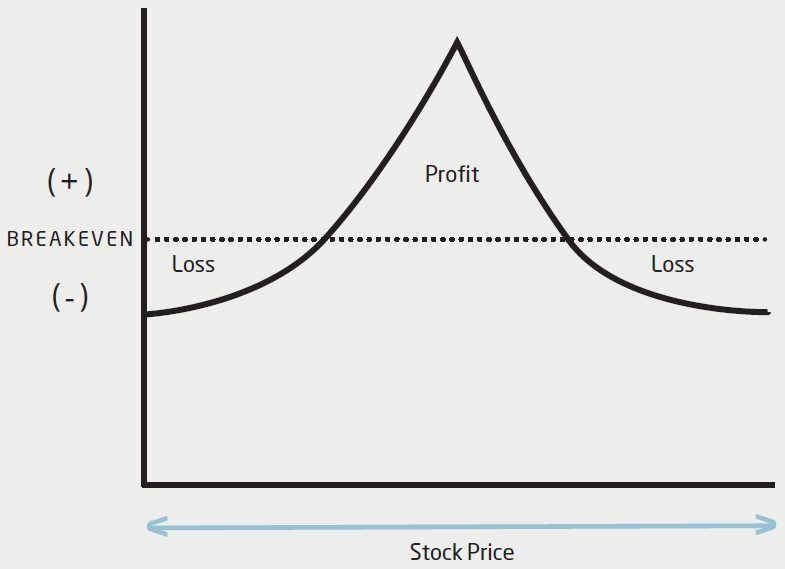

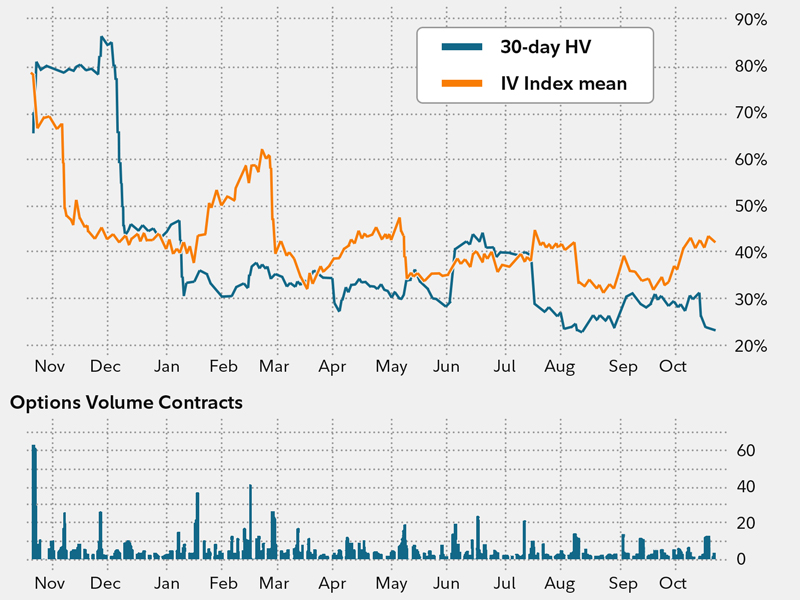

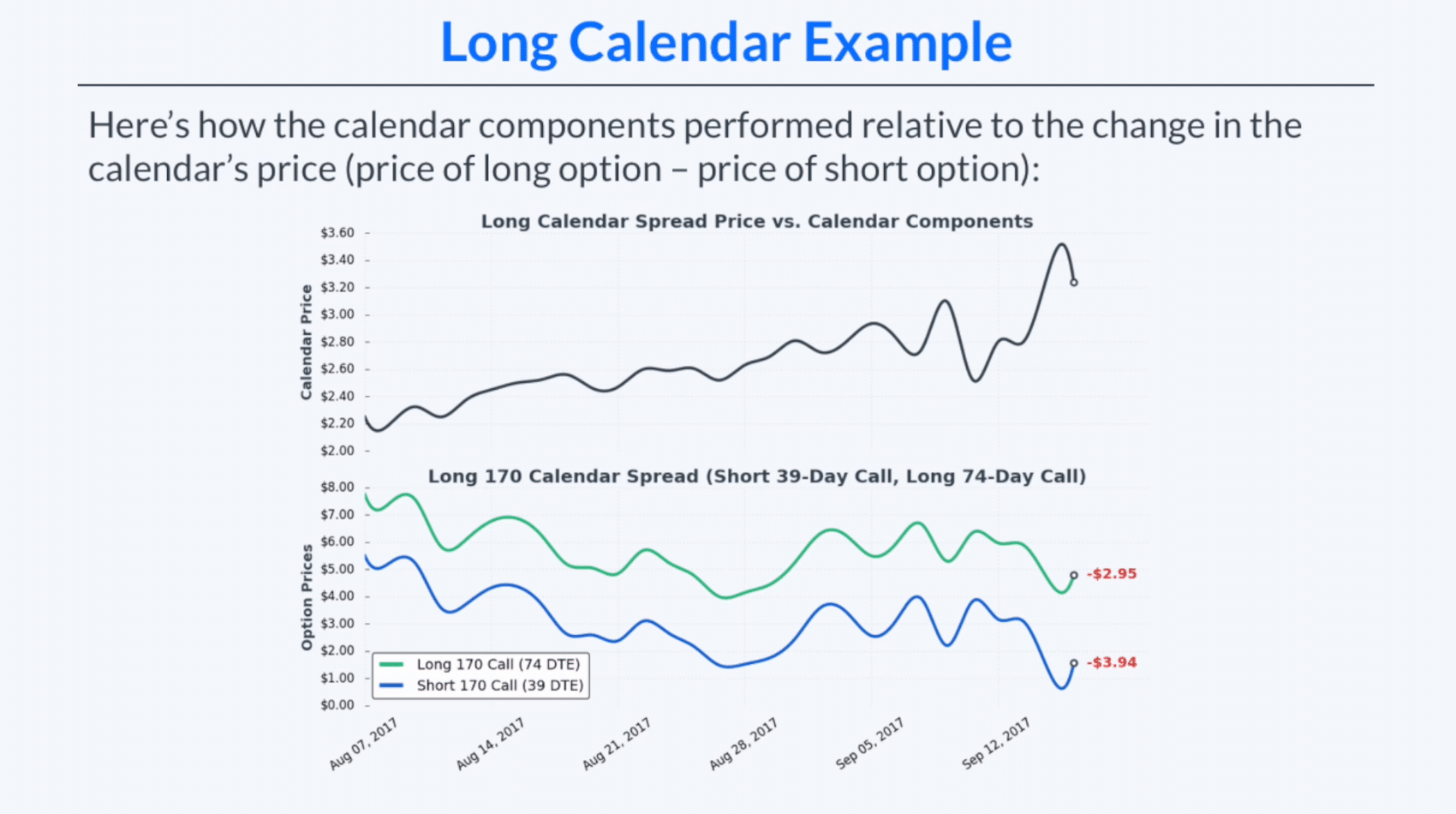

Long Call Calendar Spread - Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web calendar spread definition: Web the calendar spread. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different. This strategy profits from a decrease in the underlying price. This strategy can be done with either calls. Description short one call option and. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web calendar spread definition: Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. In options trading, a “calendar. Web calendar spread definition: Web the calendar spread. Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. This strategy profits from a decrease. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. Web what is a long call calendar spread? This strategy can be done with either calls. Running a calendar spread with calls means you’re selling and buying a call with the same strike. Running a calendar spread with calls means you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration. Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Entering into a calendar spread simply involves buying. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. This strategy profits from a decrease in the. Web calendar spread definition: In options trading, a “calendar spread” is a financial term used to describe a strategy that consists of buying and selling two options. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. This strategy profits from a decrease in. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web the calendar spread. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. Web a. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. In options trading, a “calendar spread” is a financial term. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. This strategy profits from a decrease in the underlying price. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. Web the calendar spread. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web a long calendar. Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Running a calendar spread with calls means you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration. This strategy profits from a decrease in the underlying price. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different. Description short one call option and. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. This strategy can be done with either calls. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web the calendar spread. In options trading, a “calendar spread” is a financial term used to describe a strategy that consists of buying and selling two options. Web what is a long call calendar spread? Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Web calendar spread definition: Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. In options trading, a “calendar spread” is a financial term used to describe a strategy that consists of buying and selling two options. Web calendar spread definition: Web the calendar spread. Description short one call option and. Running a calendar spread with calls means you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration. Web what is a long call calendar spread? Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. This strategy profits from a decrease in the underlying price. This strategy can be done with either calls.Call Calendar Spread

Long Calendar Spreads for Beginner Options Traders projectfinance

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Calendar Call Spread Options Edge

How to Trade Options Calendar Spreads (Visuals and Examples)

Long Calendar Spreads Unofficed

The Long Calendar Spread Explained 1 Options Trading Software

Can I Do Calendar Spreads In Robinhood Option Strategies Which Are

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

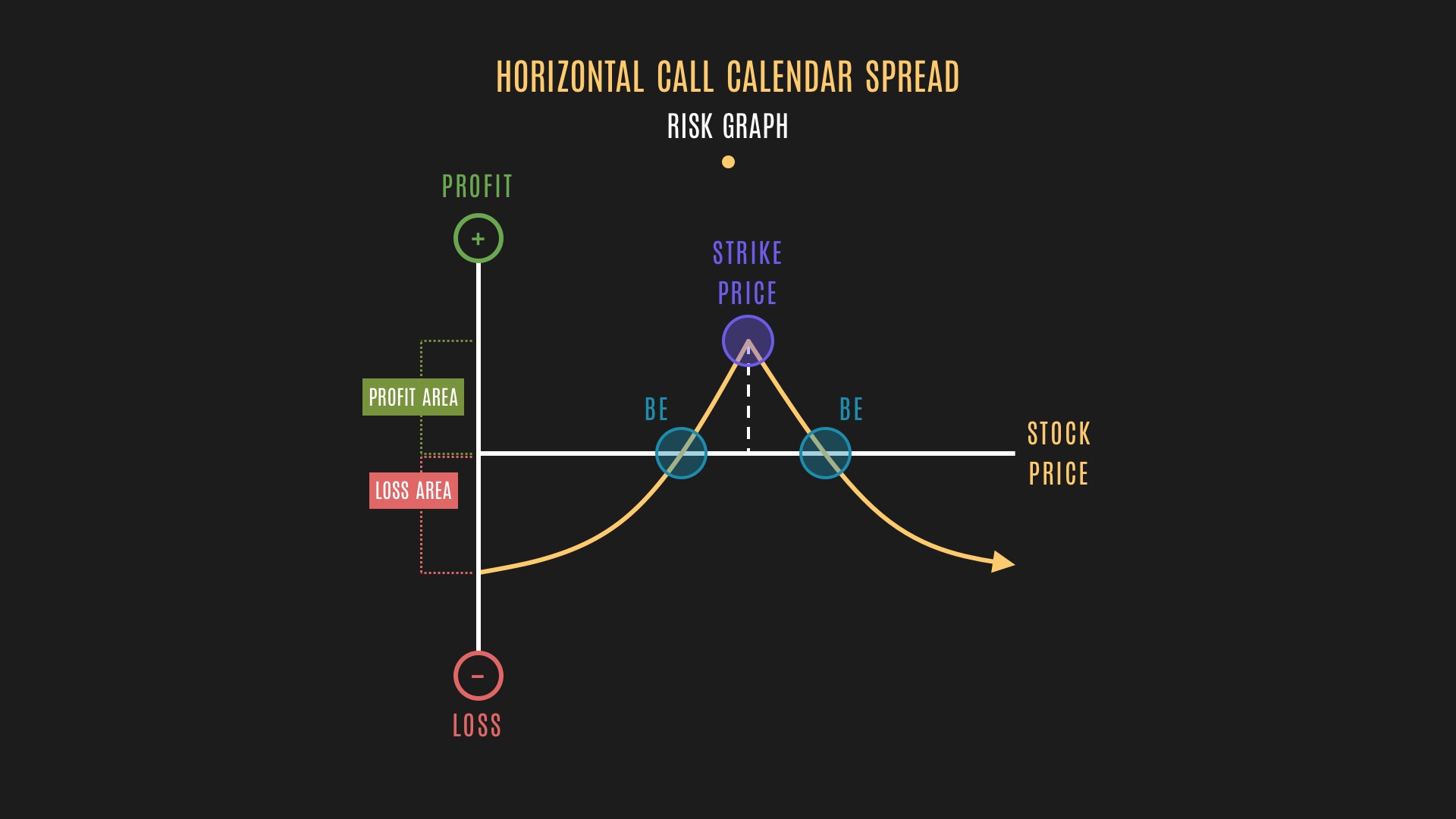

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Web A Long Calendar Call Spread Is An Options Strategy That Involves Buying And Selling Call Options With Different Expiration Months But The Same Strike Price.

Web A Calendar Spread Is An Option Trade That Involves Buying And Selling An Option On The Same Instrument With The Same Strikes Price, But Different Expiration.

Web A Calendar Spread Is An Options Or Futures Strategy Established By Simultaneously Entering A Long And Short Position On The Same Underlying Asset But With.

Web A Calendar Spread (Time Spread) Refers To Selling A Near Term Expiry Option And Buying A Longer Term Expiry Option, At The Same Strike.

Related Post:

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)