Put Calendar Spread

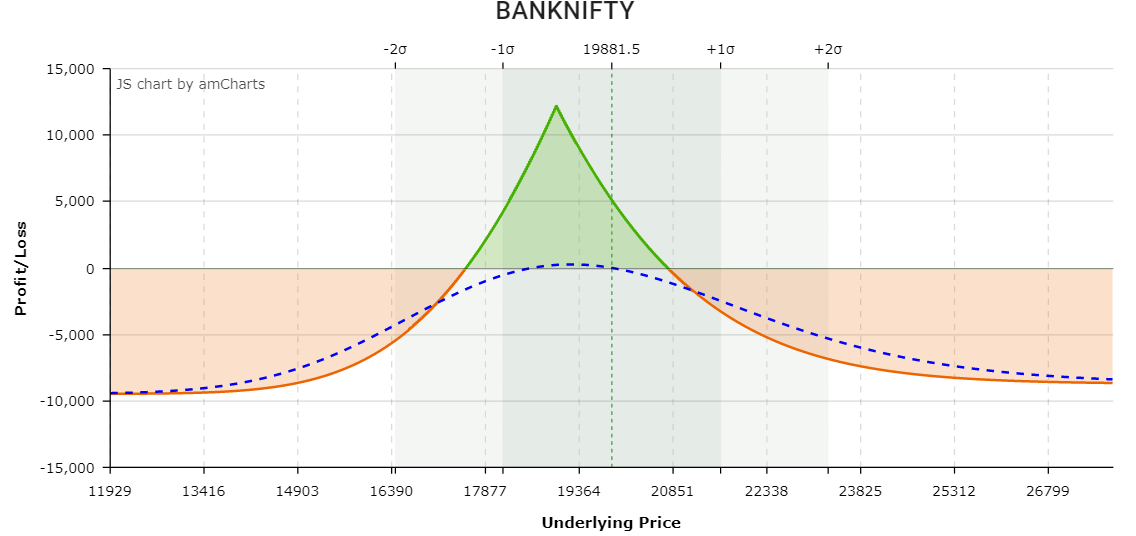

Put Calendar Spread - Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while potentially enjoying relatively large gains. Web type your message, then put the cursor where you want to insert the calendar info. Open calendar > shared calendars. December 3, 2014 / optionsanimal video transcription okay folks, hello again. Web click on settings > view all outlook settings. Web to share your outlook calendar on outlook.com, first save it as an icalendar (.ics file), import it into outlook.com, then share it with the people who need to see it. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. A put calendar is best used when the short. In the publish a calendar section, choose the calendar you want to share. You can also go to the microsoft template site where there are several. Web type your message, then put the cursor where you want to insert the calendar info. Positive theta decay with the stock near the strikes,. Web type your message, then put the cursor where you want to insert the calendar info. December 3, 2014 / optionsanimal video transcription okay folks, hello again. Choose the calendar that you want to send, then select the date. Positive theta decay with the stock near the strikes, i.e. Web what is a put calendar spread? Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Choose the calendar that you want to send, then select the date. Open calendar. They also profit from a rise in implied volatility. Positive theta decay with the stock near the strikes, i.e. Web click on settings > view all outlook settings. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. A put calendar is best used. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. They also profit from a rise in implied volatility. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future,. They also profit from a rise in implied volatility. On the file menu, click new. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Positive theta decay with the stock near the strikes, i.e. (in publisher 2010, click calendars under most popular.). Casey jensen here at optionsanimal. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. (in publisher 2010, click calendars under most popular.) click the calendar that you. You can also go to the microsoft template site where there are several. A put. Choose the calendar that you want to send, then select the date. On the file menu, click new. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. December 3, 2014 / optionsanimal video transcription okay folks, hello again. A put calendar is. Web type your message, then put the cursor where you want to insert the calendar info. Web click on settings > view all outlook settings. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Web find a calendar template for powerpoint by. Web what is a put calendar spread? Choose the calendar that you want to send, then select the date. Go to insert > calendar. Web find a calendar template for powerpoint by selecting file > new and searching for calendar. December 3, 2014 / optionsanimal video transcription okay folks, hello again. You can also go to the microsoft template site where there are several. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Web to share your outlook calendar on outlook.com, first save it as an icalendar (.ics file), import it into outlook.com, then share it with the people who need to see it. Web type your message, then put the cursor where you want to insert the calendar info. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. (in publisher 2010, click calendars under most popular.) click the calendar that you. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a. They also profit from a rise in implied volatility. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while potentially enjoying relatively large gains. Web find a calendar template for powerpoint by selecting file > new and searching for calendar. Open calendar > shared calendars. On the file menu, click new. Positive theta decay with the stock near the strikes, i.e. Web click on settings > view all outlook settings. Web what is a put calendar spread? In the publish a calendar section, choose the calendar you want to share. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Casey jensen here at optionsanimal. A put calendar is best used when the short. Web type your message, then put the cursor where you want to insert the calendar info. In the publish a calendar section, choose the calendar you want to share. Positive theta decay with the stock near the strikes, i.e. Web what is a put calendar spread? Casey jensen here at optionsanimal. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while potentially enjoying relatively large gains. Web click on settings > view all outlook settings. Web to share your outlook calendar on outlook.com, first save it as an icalendar (.ics file), import it into outlook.com, then share it with the people who need to see it. Web find a calendar template for powerpoint by selecting file > new and searching for calendar. On the file menu, click new. Go to insert > calendar. Open calendar > shared calendars. They also profit from a rise in implied volatility. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with.Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

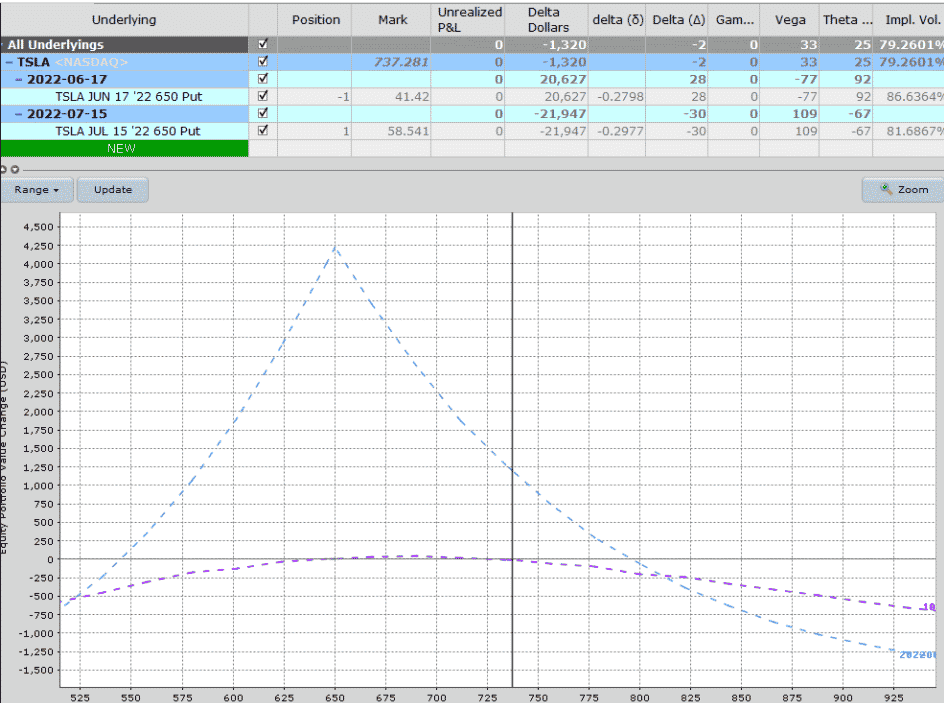

Options Trading Made Easy Ratio Put Calendar Spread

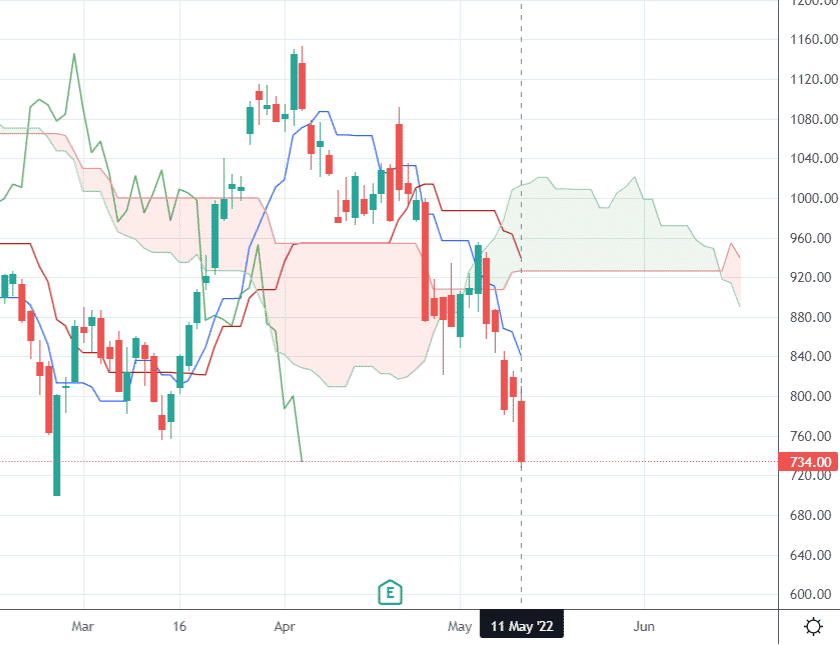

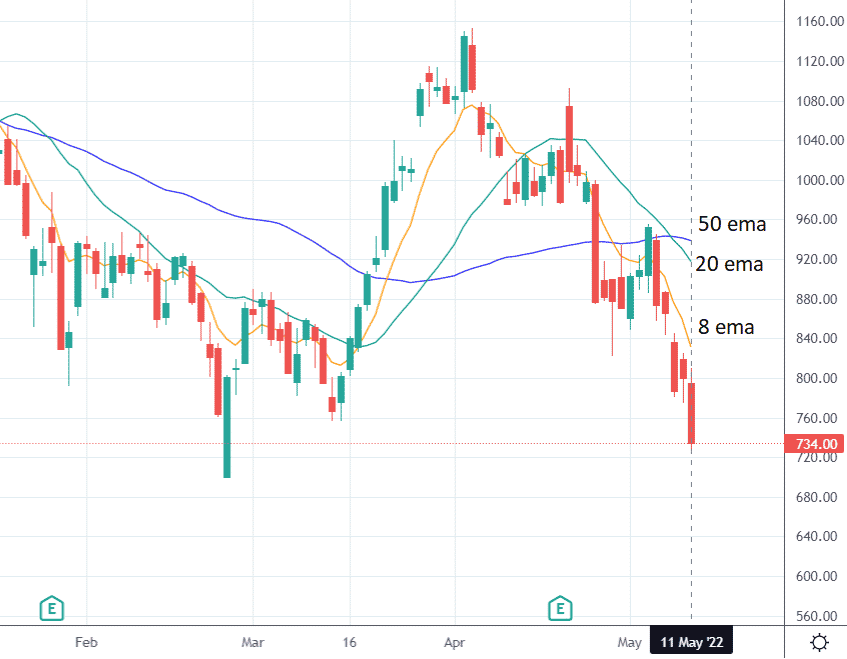

Bearish Put Calendar Spread Option Strategy Guide

Long Calendar Spread with Puts Strategy With Example

Bearish Put Calendar Spread Option Strategy Guide

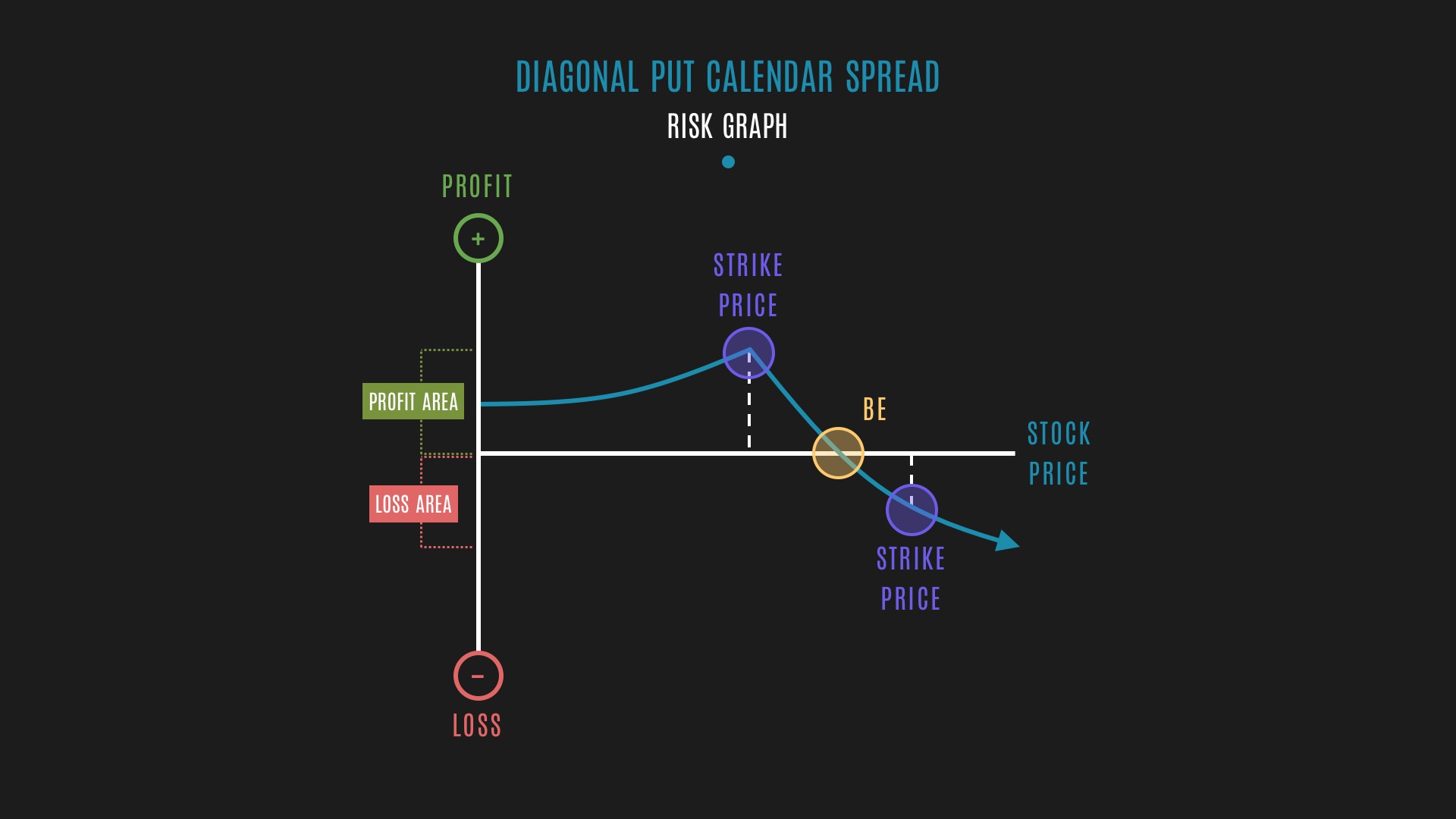

Glossary Diagonal Put Calendar Spread example Tackle Trading

Bearish Put Calendar Spread Option Strategy Guide

Calendar Put Spread Options Edge

Bearish Put Calendar Spread Option Strategy Guide

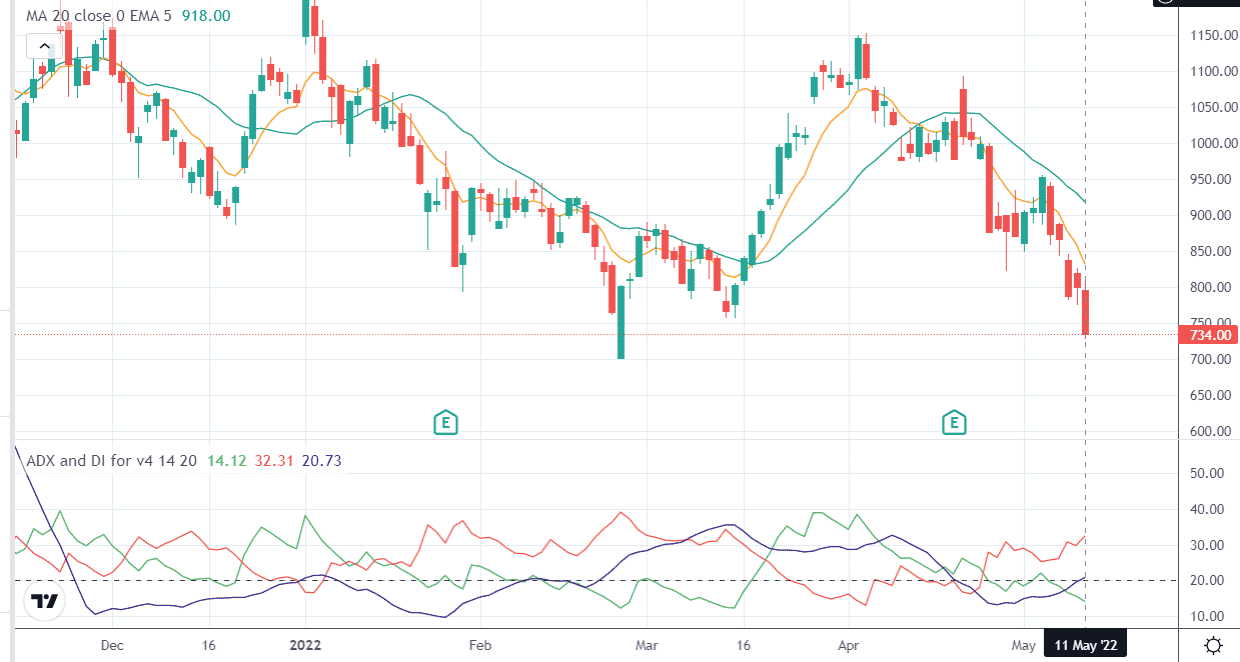

Long Calendar Spreads Unofficed

December 3, 2014 / Optionsanimal Video Transcription Okay Folks, Hello Again.

Choose The Calendar That You Want To Send, Then Select The Date.

Web A Long Calendar Put Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Puts With The Purchased Put Expiring One Month Later.

(In Publisher 2010, Click Calendars Under Most Popular.) Click The Calendar That You.

Related Post:

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)